Determining roi on investment property

ROI Gain from Investment Cost of Investment Cost of Investment. Ad AARPs Calculator is Designed to Examine the Potential Return From an Investment Property.

How To Calculate Roi On Residential Rental Property

150000 100000 100000.

. No Home Equity Loan. For example lets assume you bought the same rental property for 50000 with a mortgage loan. When comparing the results of two calculations computed with the calculator oftentimes the annualized ROI figure is more useful than the ROI figure.

You purchased a rental property in cash for 200000. ROI investment gain investment cost investment cost. Ad Access rental data from 20172022 that is pre-sorted and ready for you to use.

Buy to Let ROI. After seven years we have the same 3 annual appreciation. Estimated Additional Review 100000.

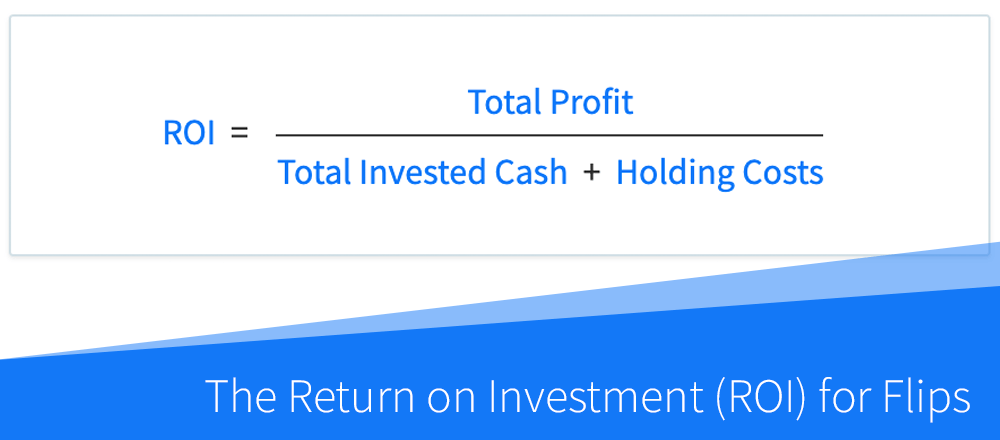

10 hours agoFor projects that promise cost savings the Additional Revenue variable in the ROI calculation is the total cost savings expected after your new feature s are implemented. ROI 100000 80000 100. So ROI Earnings gained Cost of investment Cost of investment.

RETURNS EXPENSES EXPENSES ROI. ROI or return on investment is how much you make on your investment minus the amount you put into the investment upfront and ongoing divided by the amount you put into the investment. For example if you bought a property for 100000 and sold it a year later for 150000 then your net profits would be 50000 150000 - 100000.

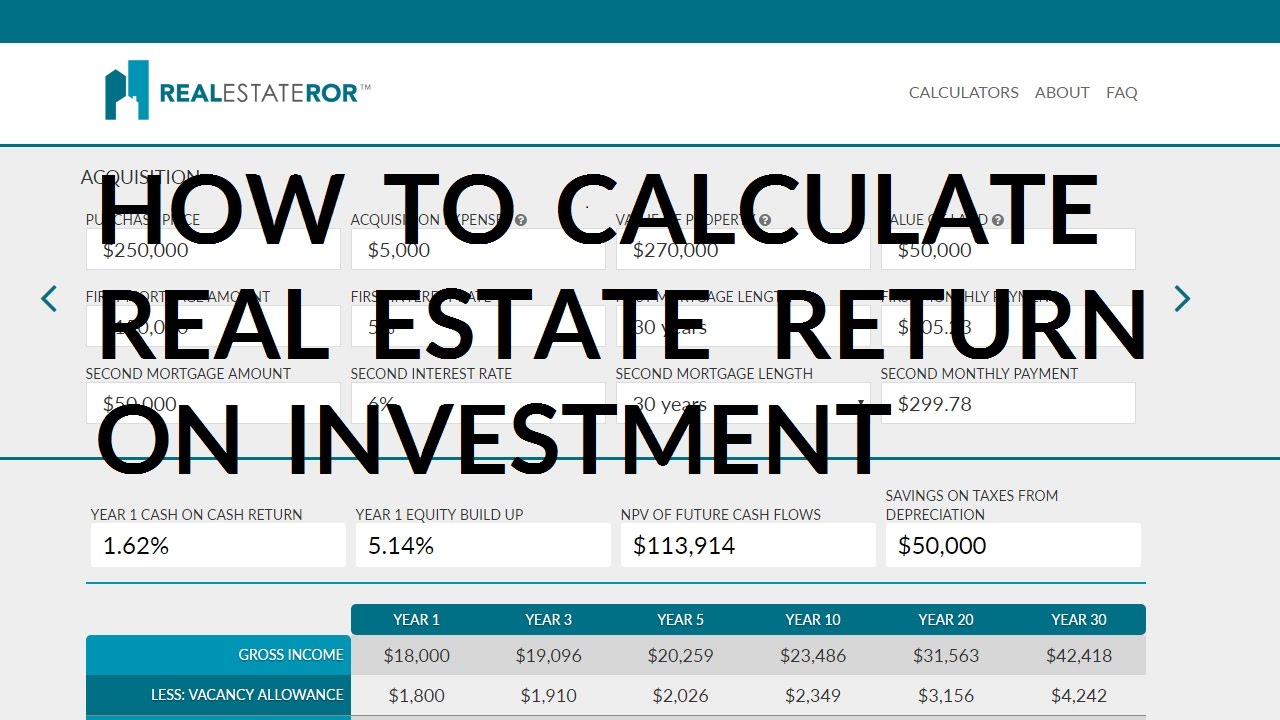

Calculate Understand Your Potential Returns. Years later you sell the property for 150000. Now in order to calculate the propertys ROI were going to divide the annual return by our original out-of-pocket expenses the downpayment of 20000 closing costs and remodeling for 9000.

Ad Need A Down Payment For An Investment Property. Here is what the formula looks like. Using our formula from above we get.

Thus your ROI would be. Shared Equity May Be The Best Solution. In London its probably going to be as low as 2.

Your closing costs came out to 2000 and repairing and remodeling costs came out. As you can see youll use one of the numbers twice to find the ROI. If you have real estate investment plans for the coming year heres a helpful guide to calculating your return on investment ROI.

For the sake of easy math lets say you acquire a property for 100000. Calculating ROI isnt the hard part. Calculating ROI for Financed Properties Determining the ROI for properties purchased with a mortgage loan isnt as straightforward as those bought with cash.

Below is an outline of how to calculate ROI If an individual purchases a property outright with no bond the profitability or ROI is calculated as follows. To give you an idea a normal Buy to Let property where you buy a house or an apartment and rent it out to a single AST contract to couple or a family will give about a 5-7 Return on Investment. The diamond versus land comparison.

Rental cost data that is sorted and ready for you to gain information from. ROI net profits investment cost. Follow Property Returns guide to learn the importance of determining ROI on Investment Property when it comes to your portfolio.

It means that over a 10 year period you received a 253 return on the original capital 37000 you invested in this property. Lets say your income on a property was 20000 and you spent 5000. 10200 50000 0204 or 20 percent.

Estimated Project Cost 80000. Your ROI is calculated with the following formula. The ROI Calculator includes an Investment Time input to hurdle this weakness by using something called the annualized ROI which is a rate normally more meaningful for comparison.

Your ROI is 300. ROI Additional Revenue Cost of Investment 100. Rent collection.

Calculating Your Rental Property Return on Investment Calculating ROI isnt that hard. Property Can Be an Excellent Investment. ROI Sale Proceeds Cumulative Cash Flow Total Invested Cash Total Invested Cash 93405 37290 37000 37000 253 So what does this number tell you.

Skip to content 1300 829 221. If a property costs R1 million and the transfer costs conveyancing fees transfer duty deeds office fee and VAT. The costs associated with the investment.

Once again well carry this example all the way to its eventual sale.

How To Calculate Roi On Rental Property Real Estate Skills

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

How To Calculate Roi On Rental Property Rapid Property Connect

Calculating Returns For A Rental Property Xelplus Leila Gharani

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Canada

How To Calculate Rental Income The Right Way Smartmove

Rental Property Cash On Cash Return Calculator Invest Four More

Calculating Return On Investment Roi In Excel

How To Calculate Roi On Spanish Rental Property

How To Calculate Roi On Spanish Rental Property

How To Calculate The Return On Investment Roi For Flips And Rehab Projects Dealcheck Blog

How To Calculate Roi For A Potential Real Estate Investment Excelsior Capital

What Is A Good Return On Investment For Rental Properties Mashvisor

Calculating Returns For A Rental Property Xelplus Leila Gharani

How Do You Calculate Return On Investment On Rental Property

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

Rental Property Calculator Most Accurate Forecast